Shares of the technology company Apple (NASDAQ: AAPL) have rallied to hit all-time highs in recent weeks, thanks in part to a WWDC (Worldwide Developers Conference) event that revealed a bit more about the firm’s AI plans. However, Apple is not just AI and a smarter Siri. The company has many ambitious new products in the pipeline, many of which could help grow its space computing business after a slow start for Vision Pro. Despite the meltdown and multiple concerns, I have to stay positive on Apple stock.

Admittedly, it’s hard to believe that AAPL stock plunged nearly 2% on the day of the WWDC presentation. Either way, it didn’t take long for analysts to drive the stock higher as they issued a wave of bullish upgrades in response to Apple Intelligence. Perhaps a little guidance was what investors needed as Apple’s AI plans came to light. Moving forward, more interesting developments could serve as even more fuel for analyst upgrades over the next 18 months.

Whether it’s worth the hefty price of admission, however, remains the big question. After all, Apple stock has rarely traded above a trailing 35 times price-to-earnings (P/E) valuation multiple.

Apple’s wealthy multiple has AI written all over it

At the time of writing, AAPL stock’s trailing price multiple (P/E) is 35.6. This is the most expensive I’ve seen Apple stock in years. The forward P/E of 30.9 times doesn’t look much better, either. Not for a stock that averages a forward P/E multiple of 25.3 times over the past five years.

Indeed, the massive catalysts go into storage right here. Most importantly, an iOS experience powered by Apple Intelligence and partnering with OpenAI to bring ChatGPT to the iPhone at no cost to Apple. Additionally, other server-side AI models (perhaps Anthropic’s Claude, Perplexity AI, or one built by Apple) could come in what Apple refers to as Private Cloud Compute (PCC).

If Apple Ink deals with other AI companies, Apple users will have many options to fulfill their requirements. Having options is never a bad thing!

Perhaps the only thing better than the world’s most proficient major language model (LLM) at any time is access to many LLMs and the ability to easily search for each one. Further, given how quickly AI models overlap each other in any given month, spreading one’s bets across multiple AIs seems to make more sense.

Perplexity AI, one of the firms Apple was in AI discussions with, allows users to swap their LLM within the platform for research purposes. Despite its small size, Perplexity appears to be the ultimate AI research disruptor.

Given the relatively small firm’s success, Apple should probably buy the company outright, if not for the AI research platform, but for the talent running the show. After all, when was the last time you heard a team of 55 people can make a behemoth like Alphabet (NASDAQ: GOOGL) sweat?

However, with Apple’s unique AI strategy and Apple Intelligence’s custom touch, I believe its trailing P/E of nearly 36x is not high enough. Early signs seem to suggest that Apple is gearing up for an AI-driven refresh cycle for the ages, with iPhone 16 shipment plans said to have risen to 90 million (11% more than the iPhone 15) for the second half of the year .

Do not forget about the spatial calculation

The Vision Pro didn’t have a pinball launch earlier this year, but it was never expected to flourish. Indeed, Apple seemed to have left itself out of the competition with the $3,500 price tag. Either that or the masses just aren’t ready yet for the most comprehensive mixed reality product on the market. The good news is that expectations are basically on the floor for the Vision Pro. As enterprise customers discover the cost-saving potential of expensive headsets and developers populate the Vision Pro App Store, things will only get better for Apple’s space computing business.

In addition to working on a cheaper variant of Vision Pro, Apple also seems ready to beef up its visionOS with new, more intuitive features. But perhaps more importantly, Apple may be looking to launch new products that act as a stepping stone in the field of spatial computing.

According to analyst Ming-Chi Kuo, Apple may be ready to produce AirPods with infrared (IR) cameras in them by 2026. Indeed, another pair of cameras could help improve the spatial computing experience. Apple is a master at delivering seamless experiences on its devices.

As the new AirPods act as an extension of the Vision Pro, Apple may be able to provide the improvements needed to convince the masses to buy a Vision Pro or the cheaper alternative that is on the way.

Is AAPL stock a buy, according to analysts?

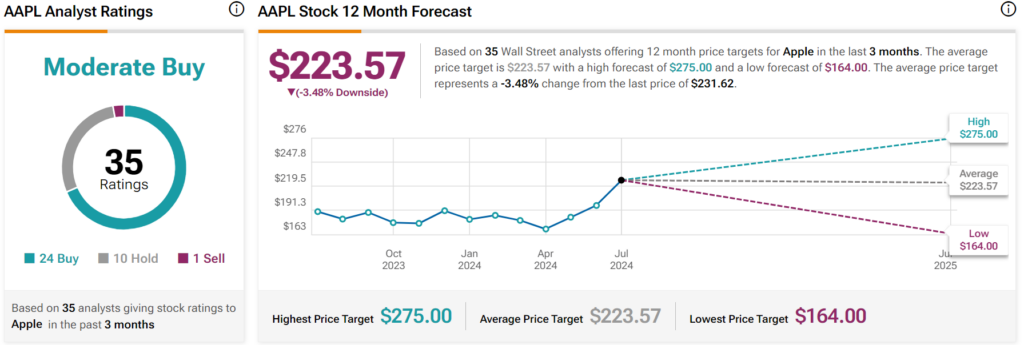

On TipRanks, AAPL stock comes in as a moderate buy. Out of 35 analyst ratings, there are 24 Buy, 10 Hold and one Sell recommendation. AAPL stock has an average price target of $223.57, implying a downside potential of 3.48%. Analyst price targets range from a low of $164.00 per share to a high of $275.00 per share.

Conclusion – Investors should be comfortable paying a Premium

Apple is firing on all cylinders on the AI front, and Wall Street is just catching up. As Apple continues to reveal more details and updates about Apple Intelligence and its AI partners like OpenAI cloud computing, investors should be happy to pay a premium price for AAPL stock.

As Apple nails it on AI, it’s retooling its spatial computing business with a cheaper model and camera-equipped AirPods to help improve the odds that a future Apple Vision device will be the hit that Vision The first pro was never.

DISCLOSURE

#Apple #NASDAQAAPL #Stock #Artificial #Intelligence #Excited #TipRanks.com

Image Source : www.tipranks.com